At Garibaldi we are constantly tracking capital placed into technology companies in Canada as well as M&A activity involving technology companies. We use existing databases, but also hear or know about transactions that those databases miss or are not announced by the companies for whatever reason. We use a broad definition of technology including such investments as Internet retail, sustainable technology and all manner of life science related technology. We also include technology enabled services in our data.

Below, we have our analysis of 2013 and 2012 to show the changes in investment levels, as well as the relative changes among the various technology sectors. We also have data from 2011 (well before Garibaldi was founded, so not as well scrubbed). As we scrub that data, we will have a look back on the changes in investment over time. For now, here are the highlights:

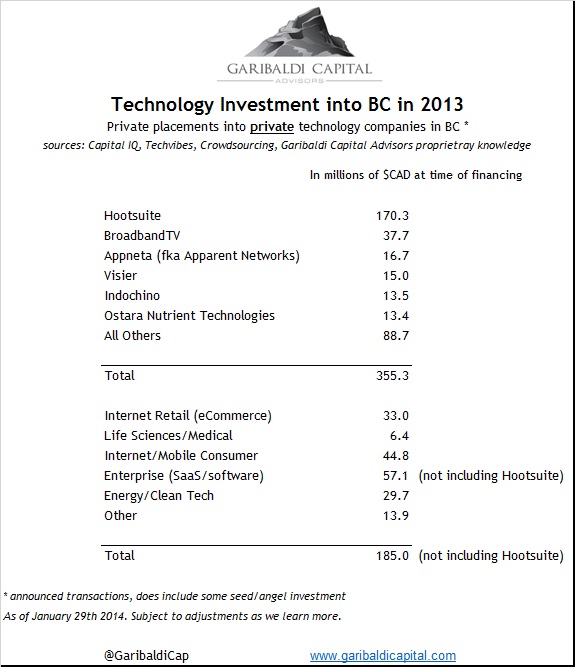

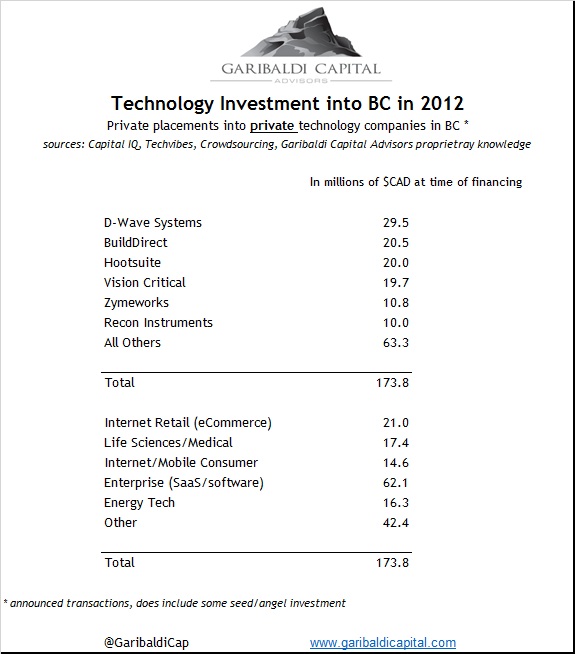

Overall investment is up 100% year over year, largely on the back of one deal, the largest private placement in Canadian technology history: Hootsuite’s US$165m raise last summer. But 2012 was a very good year with many large financings… so without Hootsuite it was an impressive capital infusion into BC just to keep pace with 2012. As we have written before, the BC technology industry is clearly on the map with many European and US investors adding significant capital in the past two years.

The Life Sciences sector is in a slump. We also have public company data (private placements by institutions directly into public companies) and public life science companies have received $21m more than is shown below. But a mere $6.4m of private company investment is desperately low. We left Hootsuite out of the sectoral data as it simply skews things too much. Even though we left it out, the leading sector for investment is Enterprise software (including SaaS). Again, without Hootsuite, it dipped slightly from 2012, but even in 2012, it is clearly where most of the investment dollars go in this province. Internet and mobile consumer focused companies (gaming, apps etc) took a big leap in 2013, largely due to the massive US$36m financing of BroadbandTV (a Garibaldi advised transaction!)

Here is the data. Feel free to replicate, just cite your source.